While year-over-year core inflation has now stopped rising. Headline inflation has fallen from a peak of 8.1% to 6.9%

The Bank of Canada has indicated its future rate decisions will be driven by economic data, but that it is “still prepared to be forceful” should the need arise.

Deputy Governor Sharon Kozicki made the comment during a speech on Thursday, in which she spoke about this week’s rate decision and the Bank’s shift towards becoming more “data-dependent.”

“We indicated that going forward, we will be considering whether to increase rates further. By that, we mean that we expect our decisions will be more data-dependent,” she said.

“If we are surprised on the upside, we are still prepared to be forceful,” she added. “But we recognize that we have raised interest rates rapidly and that their effects are working their way through the economy. In other words, we are moving from how much to raise interest rates to whether to raise interest rates.”

The inflation picture remains “mixed”

Kozicki also touched on how the bank’s monetary policy actions have so far impacted economic growth and inflation.

While she said there is growing evidence that the Bank’s rate hikes are restraining demand, on the other hand third-quarter GDP growth surprised to the upside and the economy continues to operate in excess demand.

On inflation, she said the Bank continues to see a “mixed picture.”

“On one hand, inflation remains too high, with many of the goods and services Canadians regularly buy showing large price increases,” she said. “On the other hand, three-month rates of change in core inflation have come down, an early indicator that price pressures may be losing momentum.”

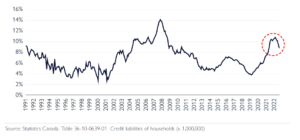

Headline inflation has fallen from a peak of 8.1% to 6.9%, while year-over-year core inflation has now stopped rising.

Looking forward to the Bank’s next policy meeting on January 25, she noted the decision will be followed by a summary of deliberations that will be published on the Bank’s website about two weeks later.

This follows recommendations from an International Monetary Fund review of the BoC’s transparency practices, in which it called on the Bank to begin publishing such summaries.

“Being open is always important, but it is especially crucial in uncertain times—and as we work to bring inflation back to our 2% target,” she said.

OSFI increases capital buffer for Canada’s big banks

Canada’s banking regulator has upped the amount of capital the country’s largest banks will be required to maintain in the event of “vulnerabilities.”

As part of its semi-annual review of the Domestic Stability Buffer (DSB), the Office of the Superintendent of Financial Institutions increased the DBS level to 3%, up from 2.5%.

It also increased the range limit for the DBS to 4%, up from 2.5%. The changes will take effect February 1, 2023.

The DBS was launched in 2018 and applies specifically to Canada’s largest banks, referred to as Domestic Systemically Important Banks, or D-SIBs.

The DBS encourages those banks to “build capital resilience to vulnerabilities, thereby reinforcing the stability of Canada’s financial system and contributing to public confidence in it,” OSFI said.

Canadians view lack of supply as a key barrier to housing affordability

Four in 10 Canadians (43%) believe housing supply is a leading contributor to the decline in housing affordability, according to a Leger survey commissioned by Habitat for Humanity.

The survey also found 40% of respondents are concerned about paying their mortgage or rent over the next 12 months, with higher percentages among Gen Zs (51%) and Millennials (52%).

Nearly three in 10 respondents (28%) said they cannot currently afford a down payment for the purchase of a home.

Published by Steve Huebl

Canadian Mortgage Trends – https://www.canadianmortgagetrends.com/2022/12/the-latest-in-mortgage-news-bank-of-canada-still-prepared-to-be-forceful/